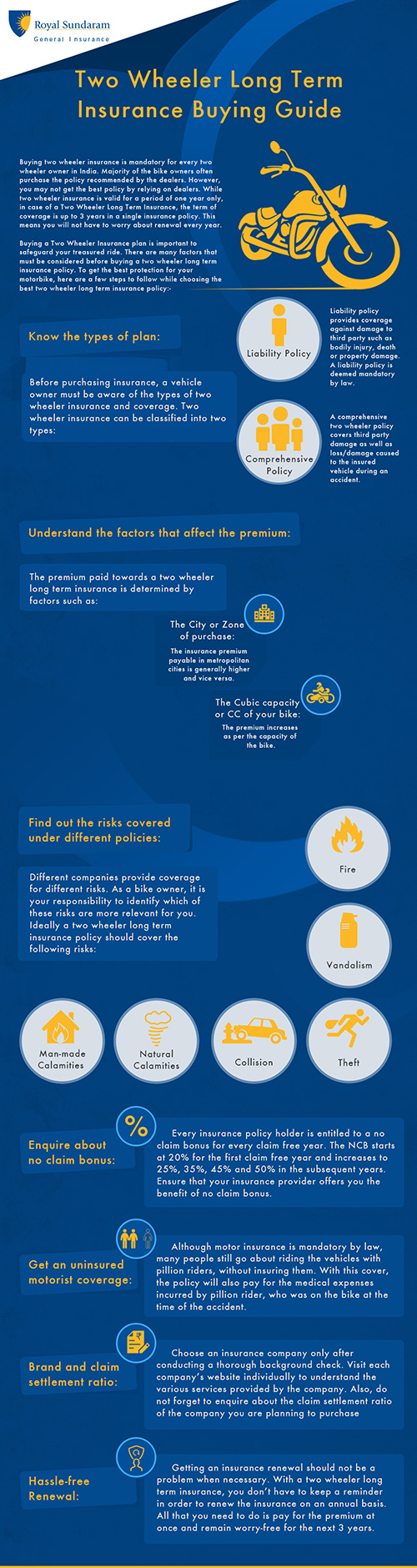

Two Wheeler Long Term Insurance Buying Guide - Infographic by Royal Sundaram

Two Wheeler Long Term Insurance Buying Guide

Buying two wheeler insurance is mandatory for every two wheeler owner in India. Majority of the bike owners often purchase the policy recommended by the dealers. However, you may not get the best policy by relying on dealers. While two wheeler insurance is valid for a period of one year only, in case of a Two Wheeler Long Term Insurance, the term of coverage is up to 3 years in a single insurance policy. This means you will not have to worry about renewal every year.

Buying a Two Wheeler Insurance plan is important to safeguard your treasured ride. There are many factors that must be considered before buying a two wheeler long term insurance policy. To get the best protection for your motorbike, here are a few steps to follow while choosing the best two wheeler long term insurance policy:-

1. Know the types of plan: Before purchasing insurance, a vehicle owner must be aware of the types of two wheeler insurance and coverage. Two wheeler insurance can be classified into two types:

- Liability policy - Liability policy provides coverage against damage to third party such as bodily injury, death or property damage. A liability policy is deemed mandatory by law.

- Comprehensive policy - A comprehensive two wheeler policy covers third party damage as well as loss/damage caused to the insured vehicle during an accident.

2. Understand the factors that affect the premium: The premium paid towards a two wheeler long term insurance is determined by factors such as:

- The Cubic capacity or CC of your bike: The premium increases as per the capacity of the bike.

- The City or Zone of purchase: The insurance premium payable in metropolitan cities is generally higher and vice versa.

3. Find out the risks covered under different policies: Different companies provide coverage for different risks. As a bike owner, it is your responsibility to identify which of these risks are more relevant for you. Ideally a two wheeler long term insurance policy should cover the following risks:

- Collision

- Theft

- Vandalism

- Fire

- Natural Calamities

- Man-made Calamities

4. Enquire about no claim bonus: Every insurance policy holder is entitled to a no claim bonus for every claim free year. The NCB starts at 20% for the first claim free year and increases to 25%, 35%, 45% and 50% in the subsequent years. Ensure that your insurance provider offers you the benefit of no claim bonus.

5. Get an uninsured motorist coverage: Although motor insurance is mandatory by law, many people still go about riding the vehicles with pillion riders, without insuring them. With this cover, the policy will also pay for the medical expenses incurred by pillion rider, who was on the bike at the time of the accident.

6. Brand and claim settlement ratio: Choose an insurance company only after conducting a thorough background check. Visit each company's website individually to understand the various services provided by the company. Also, do not forget to enquire about the claim settlement ratio of the company you are planning to purchase insurance from.

7. Hassle-free Renewal: Getting an insurance renewal should not be a problem when necessary. With a two wheeler long term insurance, you don't have to keep a reminder in order to renew the insurance on an annual basis. All that you need to do is pay for the premium at once and remain worry-free for the next 3 years.

Back

Back